how do i pay my personal property tax in richmond va

For best results run this application using Internet Explorer version 50 or later make sure Java Script and cookies are enabled and set monitor display to 1024 x 768 pixelsFor instructions about enabling Java Script click here. Property Pre-Authorized Withdrawal PAWS Dropping off items at the City Hall is an easy method.

021 The Pillars Of Fi Financial Independence Financial Independence Retire Early Smart Money

804-768-8649 Administration Individual Personal Property Income Tax Tax Relief 804-796-3236 Business License Business Tangible Personal Property Hours Monday - Friday 830 am.

. All motor vehicles including cars trucks motor homes and motorcycles boats airplanes trailers and manufactured homes garaged in the City of Suffolk are subject to personal property taxes. Personal Property Tax Rate. Based on the type of payments you want to make you can choose to pay by these options.

Is more than 50 of the vehicles annual mileage used as a business. You can also safely and securely view your bill online consolidate your tax bills into one online account set up notifications and reminders to be sent to your email or mobile phone schedule payments create an online wallet and pay with one click using creditdebit or. Click on Continue to Pay Personal Property Taxes link at the top or bottom of this page.

How Do I Pay My Personal Property Tax In Richmond Va. The personal property tax is not prorated for persons moving out of Waynesboro or for the disposal of a vehicle after January 1. Answer the following questions to determine if your vehicle qualifies for personal property tax relief.

Motor vehicles are valued by the NADA Official Used Car Guide clean loan value as of January 1. Personal Property Taxes are billed once a year with a December 5 th due date. Henrico County now offers paperless personal property and real estate tax bills.

Property Pre-Authorized Withdrawal PAWS Drop off boxes can be found at the City Hall. How Do I Pay Personal Property Taxes. Personal Property Registration Form An.

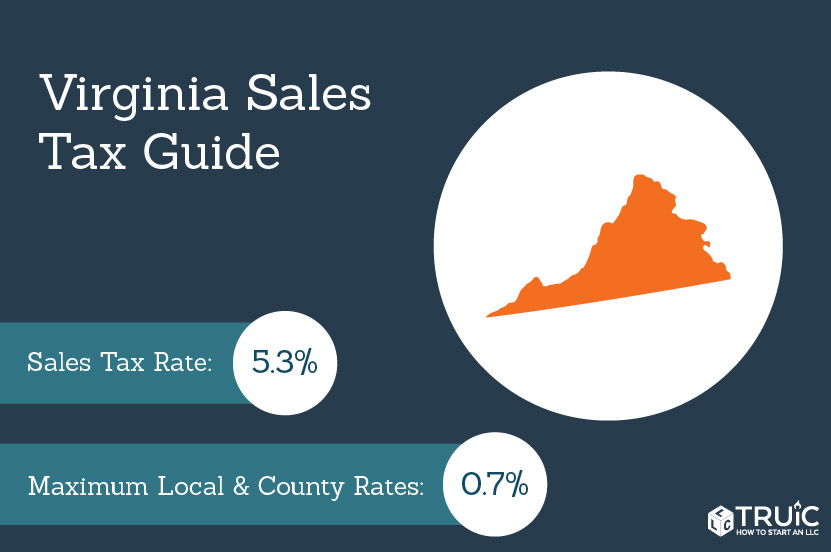

It has a population of around 224000 making it the fourth-largest city in the state. Personal Property Tax Rates Vehicles Autos trucks motorcycles and utility trailers are assessed on a prorated basis using the National Automobile Dealers Associations Blue Book NADA value at a rate of 500 per 10000. Local Taxes Personal property taxes and real estate taxes are local taxes which means theyre administered by cities counties and towns in Virginia.

How Do I Pay My Personal Property Tax In Richmond Va. On the first screen enter your email address and. Payment of the Personal Property Tax is normally due each year by October 5 see Tax Bill for due date.

Richmonds average effective property tax rate is 101. To pay the current Personal Property bill only or to add a bill using another Web application press the Checkout button. View Bill Detail Screen.

How do i pay my personal property tax in richmond va. City of Petersburg Treasurers Pay Personal Property Taxes Help. Continue to Pay Personal Property Taxes Online.

A vehicle has situs for taxation in the county or if it is registered to a county address with the Virginia Department of Motor Vehicles. Please call the office for details 804-333-3555. Service fee does apply online when using a credit card.

You can pay at your financial institution. The Treasurers Office has several ways you can pay. The fee is calculated prior to authorization so that you may either proceed or cancel the transaction.

The payment is made through your financial institution. The assessment on these vehicles is determined by the Commissioner of the Revenue. Use the map below to find your city or countys website to look up rates due dates.

Tax rates differ depending on where you live. Directly from your bank account direct debit ACH credit initiated from your bank account. When do I need to file a personal property return for my car or pickup.

It is due for the full year. To mail your tax payment send it to the following address. Credit or debit card.

If the information shown is incorrect press the Return to Search button and return to the Pay Real Estate Taxes Online screen. Personal property taxes are due May 5 and October 5. Portsmouth levies a personal property tax on vehicles boats aircraft and mobile homes.

Team Papergov 1 year ago. Personal Property Taxes are assessed on any vehicle motorcycle boat trailer camper aircraft motor home or mobile home owned and registered as being garaged in Richmond County as of January 1 st of each tax year. If you have a specific question regarding personal property tax please consult our Personal Property FAQ or call the Treasurers Office at 757-926-8731.

You may use a credit card when online service fees apply. If payment is late a 10 late payment penalty is assessed on the unpaid original tax balance. Tax rates differ depending on where you live.

Go to the mayors office for in-person consultations. If you can answer YES to any of the following questions your vehicle is considered by state law to have a business use and does NOT qualify for personal property tax relief. Tax rates differ depending on where you live.

Richmond County Treasurers Office. When a person initially acquires an automobile or truck andor moves that vehicle into Henrico County that person must file a personal property return. Invoice Cloud is a convenient payment option for paying real estate taxes and motor vehicle personal property taxes include creditdebit cards e-checks scheduled payments and automatic payments Auto-Pay.

Based on the type of payments you want to make you can choose to pay by these options. Check or money order. Vehicles that are normally garaged outside Virginia but have Virginia license plates are taxed by.

Pay another PP Bill. Richmond is the capital of Virginia and the place where Virginias property tax laws were established. Newport News VA 23607.

If you have questions about personal property tax or real estate tax contact your local tax office. Interest at a rate of 10 per annum is added beginning the 1st day of the month following the original due date. You can call the Personal Property Tax Division at 804 501-4263 or visit the Department of Finance website.

Please ensure that Adobe Acrobat andor your web browser are up to date to avoid transcription errors. Prepayments are accepted if you would like to make payments in advance of the due date for real estate and personal property taxes. At City Hall an in-person demonstration is being offered.

Pay Online Chesterfield County Va

Taxmaster Finance Consulting Psd Template Psd Templates Finance Psd

My Free Wedding Venue Comparison Chart I Did This In Excel So If You Find Its Missing Something Or Wedding Venues Checklist Free Wedding Venues Wedding Venues

Richmond Va Metro Area June 2021 Real Estate Market Update In 2021 Real Estate Marketing Real Estate First Home Buyer

Militia Lists In The Library Of Virginia Virginia Library List

Securitization Audit Stops Foreclosure Buying A Foreclosure Foreclosed Homes Foreclosures

Virginia Property Tax Calculator Smartasset

Zillow Has 260 Homes For Sale In Berea Ky View Listing Photos Review Sales History And Use Our Detailed Real Estate Filters To Find The Zillow Berea Tremont

Real Estate Tax Frequently Asked Questions Tax Administration

Rent To Own Home Program In Surrounding Richmond Va Counties Rent To Own Homes Richmond Rent

Museum Of The Confederacy Handwritten Records Sheboygan Civil War Confederate Confederate

The Best And Worst Cities To Own Investment Property Investing Investment Property City

Travelers Win As Sites For Sharing Homes Boats Rvs Meals Thrive In Airbnb S Shadow Boat Travel Best

Http Www Nicholsonolson Com Https Plus Google Com 100311491973099033070 About Hl En Accounting Services Accounting Jobs Accounting And Finance

Pay Online Chesterfield County Va

Sales Tax Increase In Central Virginia Region Beginning Oct 1 2020 Virginia Tax

Bat Dong San Va Xay Dung Skyscraper Civil Engineering Real Estate Marketing